Cryptocurrency 2022 Lifo Fifo

Cost-basis for this transaction is relatively straightforward since the most recent purchase was for 05 BTC txn 2 at a cost of 500 USD - this becomes the cost-basis. Should you use LIFO for cryptocurrency tax.

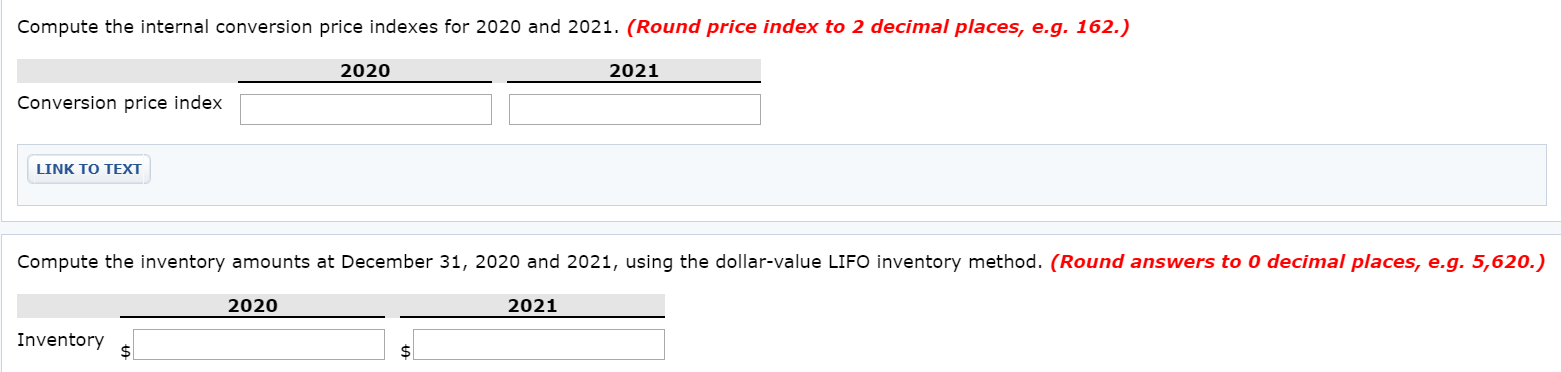

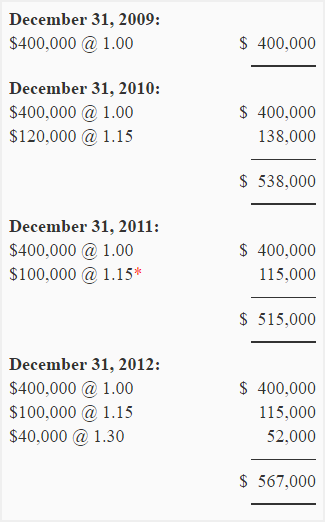

Problem 8 09 On January 1 2020 Marigold Wholesalers Chegg Com

It means it shouldnt apply and should be optional.

Cryptocurrency 2022 lifo fifo. You use that acquired date and cost basis. The FIFO-method assumes that the first goods purchased are also the first goods sold. This means that every time you spend trade or.

Without an adequate identification the only permissible method is FIFO. With FIFO the first crypto batch you acquired will be the first one to be sold meaning to calculate capital gains you will select the price of your first purchase. The LIFO method on the other hand assumes that the last goods purchased are the first goods sold.

This rule should be optional cryptocurrency. The so-called First-in First-out method FIFO and the Last-in First-out method LIFO may already be known to some investors from commercial law. Perisian Cukai Cryptocurrency.

Like-kind exchange tax loophole closed. This is done by theoretically determining which coins you are disposing of. As is expected HIFO results in the lowest overall gainloss but LIFO and FIFO can swap places depending on when you made your purchases.

Further its unclear whether this regulation applies to cryptocurrency at all. This article implies the FIFO rule shouldnt apply by default and instead should be an optional method of calculating capital gains and losses in a tax year That doesnt mean it cant or doesnt apply. There are three methods for working out your capital gain or capital loss.

There is indexation method discount method and the other method. Using LIFO method for cryptocurrency or even stock cost basis FIFO the default expected by the IRS means that you must report as selling the earliest of your purchases. Perisian cukai Cryptocurrency seperti CryptoTraderTax dapat mengendalikan semua laporan cukai cryptocurrency anda secara automatik.

Spreadsheet is ready to calculate FIFO gains up to 2000 transactions which can easily be extended further by dragging the formulas as per your requirement. FIFO is short for First-In First-Out which means that we are selling the coins in the same order as they were acquired. If the purchase price is much lower than the.

In other words we are always selling the oldest coins first. Accounting methods such as FIFO LIFO and Minimization for capital assets like crypto determine how acquisitions and sales are matched up when calculating your gain loss. While there are four methods listed there are essentially only two.

In the cryptocurrency world this is usually any fees you paid which is typically between 01-2 on popular exchanges today. In the US you can select FIFO First-in First-out or Specific Identification as accounting methods for crypto taxes. The use of LIFO instead of FIFO seems possible at this time in the absence of specific guidance from the IRS.

LIFO FIFO HIFO and specific ID are all different methodologies for evaluating your cost basis when selling crypto. Using HIFO resulted in selling through the cryptocurrency that was purchased on 0216 requiring you to sell a portion of your 0217 purchase as well. FIFO first-in first-out LIFO last-in first-out and HIFO highest-in first-out are simply different methods used to calculate cryptocurrency gains and losses.

Cryptocurrencies are treated as property per the IRS Notice 2014-21. You can choose the method that gives you the best result based on your circumstances that is the smallest capital gain. I also showcased why precise tracking is very important.

According to the answer to this question were allowed to use FIFO HIFO or ACB for crypto tax calculations. But as you can see there is risk involved. Traders who use the LIFO method of accounting calculate capital gains on the difference between the price of the sale and the most recent buy price.

With that said FIFO or Lowest in First out LIFO. This means that different accounting methods can be used to calculate your crypto taxes. In the IRS crypto tax FAQ it was clarified that specific identification choosing which cost bases to use for sales is allowed for crypto.

Platform ini menyokong beberapa kaedah pengekosan yang berbeza seperti FIFO LIFO. As txn 2 was fully used as the cost-basis for txn 3 you now move to the crypto. From an accounting standpoint each method sells specific assets in a different chronological order which ultimately leads to a different total capital gains or loss numbers on paper.

Cukup muat naik sejarah transaksi crypto anda ke dalam platform dan hasilkan keperluan anda laporan cukai crypto dengan klik butang. In summary HIFO would result in the least amount of taxes and be the preferred tax lot ID method for many crypto taxpayers. If the IRS disagrees with the use of LIFO for crypto trades you may face additional taxes plus penalties.

In Forex trading foreign currency trading there is a first in first out FIFO rule. First in first out FIFO Specific ID of which LIFO and HIFO are subsets. Last In First Out LIFO is the opposite of FIFO - here the most recently bought coins are sold first.

Bitcoin Cryptocurrency LIFO Gain Excel Calculator is a very easy-to-use handy Excel sheet for calculating the gains in Bitcoin and other crypto trading using LIFO method. Even though LIFO typically requires traders to use a higher tax rate the resulting tax burden may end up being less than the FIFO method because price swings tend to be smaller in the short term. How Crypto Taxes Work.

Understanding how Specific ID First in first out FIFO Highest in first out HIFO affect your cost basis could unlock straight forward easy to implement tax saving opportunities for crypto users.

Bitcoin Cryptocurrency Option Finance Cryptocurrency

Problem 8 09 On January 1 2020 Marigold Wholesalers Chegg Com

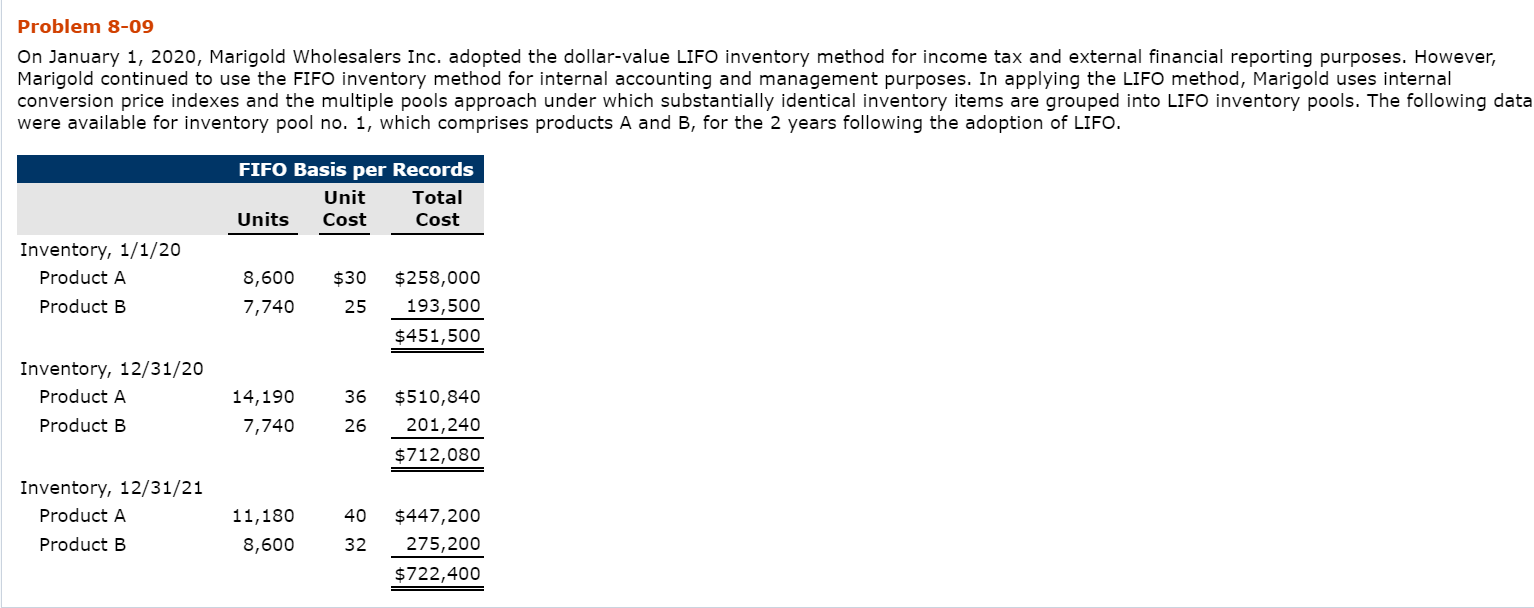

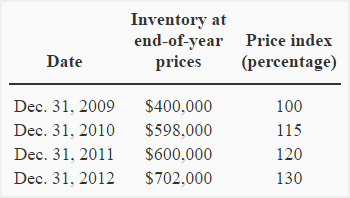

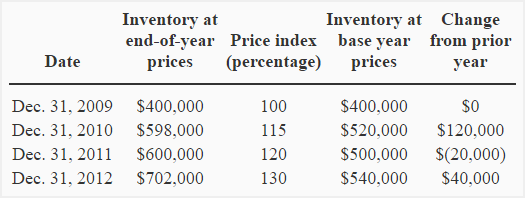

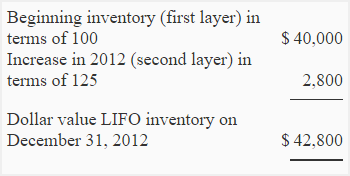

Dollar Value Lifo Method Explanation And Example Accounting For Management

Pengertian Metode Pencatatan Persediaan Barang Dagang Laporan Laba Rugi Laba Bersih Pencatatan

Bagaimana Jurnal Inventory Untuk Kehilangan Persediaan Jurnal Keuangan Pencatatan

Why Was The Last In First Out Lifo Inventory Valuation Method Banned Under International Financial Reporting Standards Ifrs Quora

Dollar Value Lifo Method Explanation And Example Accounting For Management

Dollar Value Lifo Method Explanation And Example Accounting For Management

Why Was The Last In First Out Lifo Inventory Valuation Method Banned Under International Financial Reporting Standards Ifrs Quora

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com Excel Tutorials Excel Shortcuts Business Budget Template

Dollar Value Lifo Method Explanation And Example Accounting For Management

Pengertian Variabel Costing Adalah Manajemen Keuangan Keuangan Perencanaan

8 4 Identify Special Issues Related To Lifo Flashcards Quizlet

![]()

Is Transferring Bitcoin Between Wallets Taxable Cointracking Blog

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com Excel Tutorials Excel Shortcuts Business Budget Template

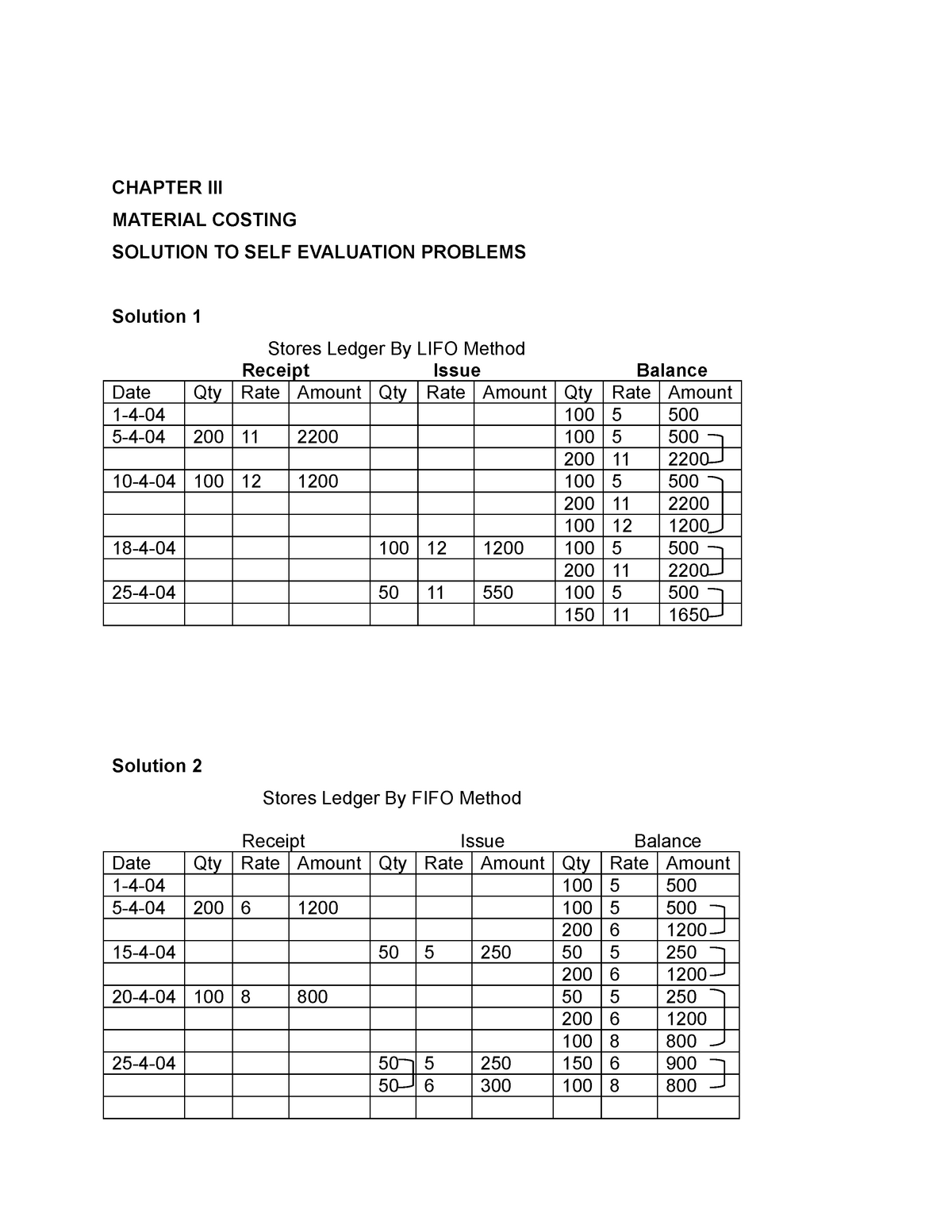

Chapter Iii Materials Costing Solutions Chapter Iii Material Costing Solution Studocu

8 4 Identify Special Issues Related To Lifo Flashcards Quizlet