Capital Loss Deduction Cryptocurrency

In the first year where capital losses are realized capital losses can only be. Taxpayers can deduct 3000 in capital losses a year 1500 if you are married and filing a separate tax return.

Tutorial Crypto Taxes For Beginners

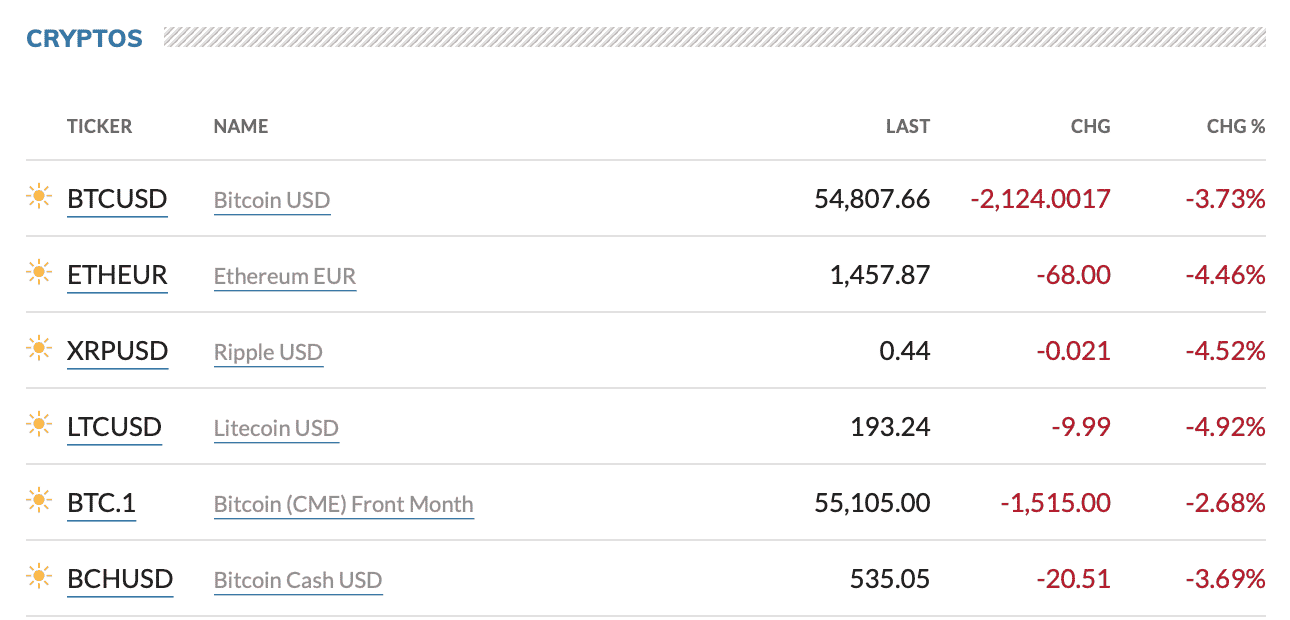

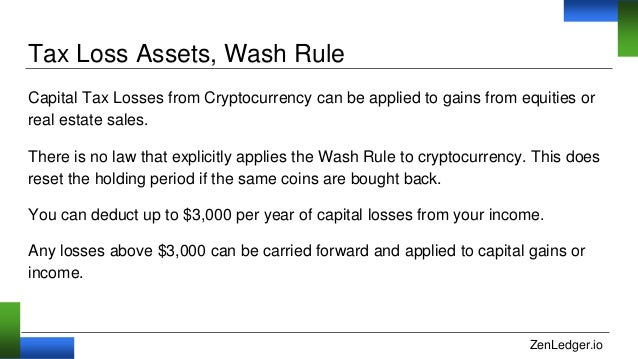

At this point the best that can be done is to use any 2018 cryptocurrency losses to offset other 2018 capital gains and up to 3000 of ordinary income.

Capital loss deduction cryptocurrency. You can carryover capital losses forward each year. 3k worth of losses can be deducted from capital income or ordinary income each year until the full amount is deducted. On the other hand a capital loss is a loss on the sale of a capital asset such as a stock mutual fund real estate or cryptocurrency.

In the US the IRS lets you deduct up to 3000 worth of net capital losses each year from the amount of money youve earned at your day job. In this guide well explore exactly what tax benefits crypto losses. If you currently make just over 50000 per year at your job that 3000 cryptocurrency loss could place you in a lower tax bracket.

Tax software for cryptocurrencies will automatically calculate your net loss so you can use this loss to offset capital gains or deduct from your income. If you have a net capital loss you can use it to reduce a capital gain you make in a later year. You cant deduct a net capital loss from your other income.

This is the basic process for reporting the majority of cryptocurrency transactions. If you go ahead and sell your BitcoinEthereum and realise the 1000 loss then you can offset this against your 800 capital gain on the shares. The amount of tax you pay on crypto gains depends on how long you held the asset for.

One very large benefit for cryptocurrency investors is a consequence of the current taxation structure for cryptocurrency which treats cryptocurrency. How much tax do I pay on crypto gains. In the example above if you are a trader who.

If you have more capital losses than you have gains for a given year then you can claim up to 3000 of those losses and deduct them against other. The capital loss deduction lets you claim losses on investments on your tax return using them to offset income. The good news is that the 475 f election allows traders to deduct crypto trading losses without being subject to the 3000 annual limit.

This means that when you realize losses after trading selling or otherwise disposing of your crypto your losses get deducted from other capital gains as well as ordinary income up to 3000. Annual net capital gainloss calculations can get especially complicated with cryptocurrency. As with capital gains capital losses are divided by the.

Do not make the mistake of not including your capital losses from 2018 which were not deducted during the tax year on last years return. Can You Write Off Crypto Losses On Taxes. Your net capital loss above the 3000 threshold is carried forward to future years.

It works like this. Claiming your cryptocurrency capital losses can result in a higher refund on your tax return via this deduction. As we discuss in our bitcoin capital losses guide up to 3000 of net capital losses are deductible in any given year.

Larger losses will carry forward to future tax years. You can use crypto losses to either offset capital losses including future capital losses if applicable or to deduct up to 3k from your income. Any additional cryptocurrency and other capital losses must be carried forward for use in future years.

You must keep records of each cryptocurrency transaction to work out whether you have a made a capital gain or loss from each CGT event. It would be worth reporting the scam to ASIC. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules.

The remaining 200 capital loss is NOT included as a tax deduction on your income but instead is carried forward into following years until you do make a capital gain at which point it will offset it. Reporting your losses on crypto transactions has the added benefit of potential tax deductions. If you dont have any capital gains to offset with your cryptocurrency losses you can deduct up to 3000 per year from your ordinary income.

However in any given tax year the maximum amount of net capital loss after going through netting procedures described above you can deduct on your tax return is 3000. Deducting Your Crypto Losses One of the biggest benefits of claiming a loss is that you can offset income gained from other sources.

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit Blog

Tutorial Crypto Taxes For Beginners

With Crypto Tax Season Upon Us The Transient Ascent Of Cryptocurrencies May Turn Into A Two Edged Sword Income Tax Return Income Tax Return Filing Income Tax

Your Crypto Tax Questions Answered Lexology

Tax On Cryptocurrency In Spain The Best Place In Eu 2021

Cryptocurrency Cpa Training Zenledger Io

Pin On Bitcoin Cryptocurrency News Cast

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

Crypto Tax Tips To Start 2018 Right Blockchain Cryptocurrency Filing Taxes

Message Or Email Me For More Information And Let S Start Saving Tjones Sweeneyconrad Com How To Plan Bitcoin Let It Be

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Unfortunately You Lost Money On Your Crypto Currencies Invesments Such As Bitcoin Ethereum Tether Litecoin Capital Assets Crypto Currencies Virtual Currency

Will Bitcoin Do For Banks What Email Did For The Post Office Bitcoin Crypto Coin Things To Sell

Kikmoney Earn Free Bitcoin Usd New Mining Site Earn Daily 50 Urdu Mining Site Bitcoin Free Bitcoin

Virtual Currency 01 Bitcoin Btc Bit Coin Crypto Currency Usa Seller Direct To Your Wallet Https Rov Virtual Currency Bitcoin Investing In Cryptocurrency

Cryptocurrency Taxes 2020 What You Need To Know Business News Investment Madison Com